Intermediate Strategies to Level Up Your Credit Card Strategy

Introduction

You started off with a couple of credit cards that earn transferable points. Then you got a taste for travel rewards. But now you’re struggling to achieve good redemptions.

In this article, we’re going to look at common challenges and frequently overlooked options for:

- Lodging

- Flights

- Earning points

Along the way, we’ll explore program sweet spots and how having the right tools can make everything much easier. In this article, we’ll be moving, gradually, from a strategy with 2-3 credit cards to one with 5-8.

Lodging

It’s hard.

- No bank has acceptable transfer rates to the big three (Hilton, Marriott or IHG).

- Only Chase and Bilt transfer to Hyatt.

- Only Citi and Capital One transfer to Choice and Wyndham.

With the right tools, it can be much easier.

Cobranded Credit Cards

When I think of travel hacking tools, I often think first of hotel credit cards. They can be fantastic deals, offering large signup bonuses, status, annual free night certificates, ongoing discounts, and more, usually for under $100. For most cards, you will double the value of the annual fee every year just by redeeming a free night.

Choice Privileges Select ($95)

- Annual 30k points.

- Automatic Platinum status.

Hilton Honors Surpass ($150)

- 4x $50 quarterly credits.

- Fifth night free (from status).

- Automatic Gold status.

IHG Premier ($99)

- Annual 40k certificate.

- Fourth night free on award bookings. favorite

- Automatic Platinum status.

Marriott Bonvoy Boundless ($95)

- Annual 35k certificate.

- Automatic Gold status.

World of Hyatt ($95)

- Annual category 1-4 certificate.

- Automatic Discoverist status.

Wyndham Rewards Earner+ ($75)

- Annual 7,500 points.

- 10% rebate on all redemptions. favorite

- Automatic Platinum status.

These are two of the best benefits in the game.

- IHG’s 4th night free can mean a 30% discount on longer award stays.

- Wyndham’s 10% rebate makes all your points 11% more valuable.

Transferable Currencies

In the world of hotels, there are points you earn and points you buy.

Only two bank-to-hotel transfers consistently exceed 1.5 cents of value per bank point.

- Hyatt from Chase or Bilt at a 1:1 ratio.

- Choice from Citi at a 1:2 ratio.

Hyatt from Chase or Bilt

At roughly 2 cents per point, Hyatt has the highest value currency of any major hotel program, more than double Marriott and roughly four times Hilton and IHG.The basic strategy is fairly simple. Maximize earning in currencies that transfer to Hyatt.

In addition to maximizing earnings, you may wish to reserve these currencies for Hyatt unless you find an exceptional offer.

Choice from Citi

Not all Choice redemptions are going to be good value. We are mainly interested in particular brands, partnerships and sweet spots where Choice consistently offers exceptional value.- Preferred Hotels of the World

Independent luxury hotels that are particularly strong in Europe. - Strawberry Hotels (formerly Nordic Choice)

Independent and chain hotels in Nordic countries, some operating as better versions of Choice brands. - Ascend Hotels

Choice’s brand for higher end independent hotels. - Radisson Hotels

Acquired by Choice in 2023, many sub-brands like “Blu” are nice. - Sweet Suite Spots

Choice often prices standard rooms and suites the same.

Using this list, it’s pretty easy to find redemptions valued between 0.8 and 2.0 cents per Choice point, but it gets much better.

Citi points transfer to Choice at a 1:2 ratio.

Transfer: 100,000 Citi points.

Receive: 200,000 Choice points.

Additionally, if you have a Citi Rewards+ card, you will receive a 10% rebate on any Citi award redemptions up to a maximum of 10,000 points rebated per year.

Transfer: 100,000 Citi points.

Receive:

- 200,000 Choice points.

- 10,000 Citi points.

Together, this puts Choice on par with Hyatt transfers on a purely cents per point basis.

Point Purchases

Our goal in buying hotel points should be to get a 30% discount, or better, over cash rates.

Buying points can be good value for any program if you have a high value redemption lined up, but it’s usually a bad idea to speculatively purchase points because hotel and airline currencies are always at risk of devaluation.

That said, a few hotel programs routinely put their points on sale at prices which make them a fairly safe bet when combined with the right knowledge, tools and probable redemptions.

- Choice around 0.7cpp.

- Hilton at 0.5cpp.

- IHG at 0.5cpp.

- Wyndham around 0.9cpp.

We’ve covered Choice’s sweet spots above, so let’s dive into the other three.

Hilton, IHG and Nth Night Free

Both Hilton and IHG offer a discount on longer award stays.- Hilton: 5th Night Free

With Hilton Honors Silver status or higher.

Automatic with certain credit cards. - IHG: 4th Night Free

With the IHG Premier credit card.

On the surface, this would seem to be a 20-25% discount. However, it is actually every 4th (or 5th) night which is free, not the cheapest night. IHG in particular uses heavily dynamic award pricing which results in a wide range in per night prices.

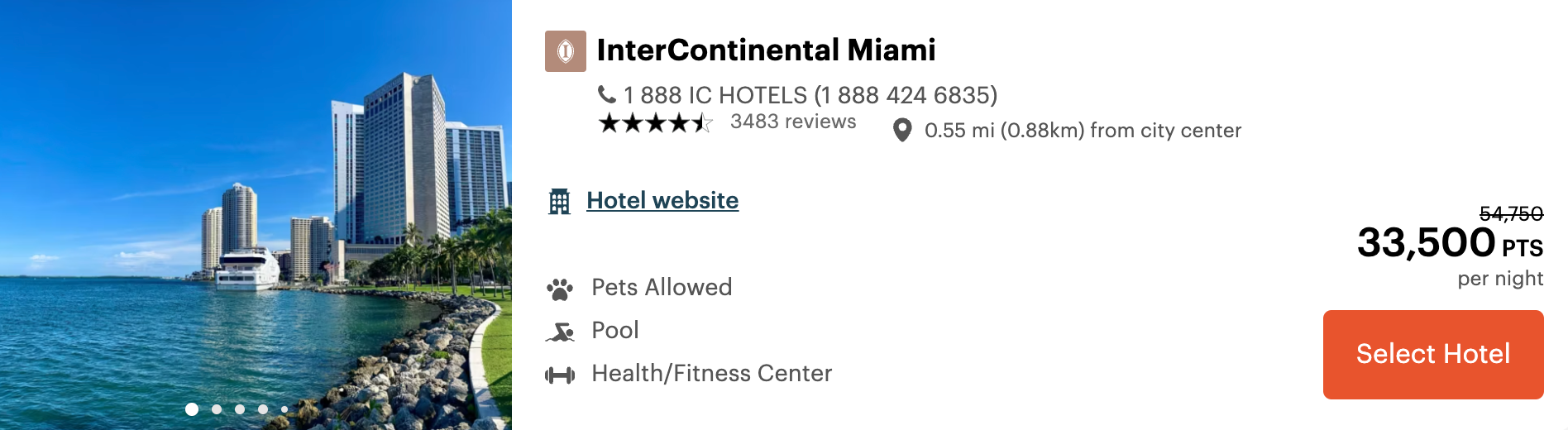

Let’s look at a real world example, using numbers from the IHG website. In this case, we’re trying to book four nights at the Miami InterContinental over Christmas.

- Using 4th night free saves 85k points.

- Buying points saves 50% on the cash price.

Show me detailed pricing

With a little effort, we can tease apart how much IHG charges for each night including the destination fee and taxes. For clarity, I’ve placed the points purchase price in parentheses based on IHG’s standard 0.5 cents per point sale.

| Item | Cash | Points |

|---|---|---|

| Tues. 12/24 | $227 | 35k ($175) |

| Wed. 12/25 | $246 | 41k ($205) |

| Thurs. 12/26 | $341 | 58k ($290) |

| Fri. 12/27 | $526 | |

| Room Subtotal | $1,340 | 134k ($670) |

| Destination Fee | $132 | $132 |

| Taxable Total | $1,472 | $132 |

| City Tax (6%) | $88 | $8 |

| State Tax (7%) | $103 | $9 |

| Cost of Points | $0 | $670 |

| Grand Total | $1,663 | $819 |

We are saving over 50% on the cash rate by:

- Buying points at 0.5cpp and redeeming at 0.65cpp against the nightly rate.

- Needing 85k fewer points due to 4th Night Free.

- Avoiding $175 in state and local taxes.

The math won’t always work out this well. Hilton tends to have less variation in their prices. On the dates you need, the free night could be the cheapest night, and you won’t always get a 0.65cpp base redemption.

I should also note that we haven’t factored in how many points you could be earning by paying cash, directly and indirectly.

Even so, we now have a tool to book many properties at a huge discount.

Wyndham and Vacasa

Wyndham periodically sells points around 0.9 cents per point, and these can often be redeemed for 1.5 to 1.8cpp by booking Vacasa rentals.Vacasa, which is similar to VRBO or AirBnB, has a wide range of properties spread across North America and Hawaii. The highest concentrations are found in tourist areas or along the coasts.

Units will either be:

- 15,000 Wyndham points per bedroom per night for cheaper places.

- 30,000 points per night for moderately expensive places.

- Unbookable for anything else.

These must be booked over the phone and figuring out the exact price in advance can be tricky.

Show me the pricing formula

Prices are based on the reservation’s average cost per bedroom per night including all taxes and fees. To simplify things, we’ll refer to this as the reservation’s Average Room Rate or ARR.

Given the following stay.

- 2 bedroom condo.

- 4 nights.

- $1600 total cost.

Average Room Rate (ARR):

- $200 = ( $1600 / 2 bedrooms ) / 4 nights

If the ARR is under $250, you will pay 15,000 Wyndham points per bedroom per night.

- 15,000 points/night for 3 nights in a 1 bedroom totalling @ $240/night.

- 30,000 points/night for a 2 bedroom @ $260/night.

- 45,000 points/night for a 3 bedroom @ 749/night.

If the ARR is between $250 and $500, you will pay 30,000 points per bedroom per night.

- 30,000 points/night for a 1 bedroom at $300/night.

- 60,000 points/night for a 2 bedroom at 900/night.

- 90,000 points/night for a 3 bedroom at 900/night.

If the ARR exceeds $500, you will not be able to book the rental with points.

- Unbookable: 1 bedroom at $600/night.

- Unbookable: 2 bedroom at $1,100/night.

Normally, the best you can do is 1.67cpp ($250/15,000).

However since these are Wyndham redemptions, holders of the Wyndham Earner+ or Wyndham Business Earner credit cards receive a 10% discount on award bookings. In this case, you can achieve a theoretical 1.85cpp ($250/13,500).

Three caveats:

Vacasa stays are non-refundable within 30 days.

When booking a Vacasa, you’re going through Wyndham, through Vacasa, with an owner and condo association potentially hidden somewhere on the backend. It’s like booking fourth or fifth party and problems can be difficult to address.

Wyndham devalued Vacasa redemptions in the fall of 2023 and again in early 2024, dropping the per night limit from $500 to $350 to $250 where it sits now. This was widely regarded as necessary in the interests of sustainability, but it remains to be seen if the devaluations are done.

Flights

It is easy to book amazing flights, redeeming for 5, 10, even 15 cents per point. At the same time, it can feel virtually impossible if you start adding pesky constraints like a starting city, specific destination, airlines, dates or loyalty programs.

With hotels, your choice was among six programs that work across the entire world, but with airlines strategies may be limited to specific regions, routes or rules. There are over 100 airlines with 200 daily flights and alliances within alliances.

The problems we encounter can also be very different depending on:

- Where we live in relation to major hubs.

- Which airlines serve our airport.

- Who we fly with (families or solo).

- When we like to book.

- When and where and how we want to fly.

In this section, we’ll look at tools, strategies and the problems they solve.

Credit Cards

For brand loyal frequent flyers and those chasing status, airline credit cards can be a good deal. For the rest of us, it’s mostly about collecting a large signup bonus, getting free bags, spending for a companion fare or getting access to discounted award prices.

Alaskan Airlines

Bank of America*

- Alaskan Airlines Visa Signature ($95)

Strategy

- Collect a large signup bonus in year one.

- Keep and spend for a $121 Companion Fare.

- Or cancel in year two.

American Airlines

Citi

- Executive ($595)

- Platinum Select ($99)

- MilesUp ($0)

Strategy

- Collect a large signup bonus in year one.

- Product change at renewal to a free card.

CustomCash, DoubleCash, Rewards+ or MilesUp. - Cards are especially useful for chasing status.

Barclay

- Aviator Red ($99)

Signup bonus normally awarded after first purchase. - Aviator Silver ($250)

Available only by targeted upgrade offer.

Strategy

- Collect a large signup bonus in year one.

- Cancel in year two OR fish for an upgrade offer to Silver (frequent main cabin American flyers only).

Delta Airlines

American Express

- Reserve ($650)

- Platinum ($350)

- Gold ($150)

- Blue ($0)

Strategy

- Collect a large signup bonus in year one.

SkyMiles are a lower value currency. - Product change to the free Blue card or cancel.*

- Cards are especially useful for chasing status.

- 15% discount on Delta awards with Gold or higher.

It’s often better to book Delta through partners.

Southwest

Chase

- Priority ($149)

- Premier ($99)

- Plus ($69)

Strategy

- Collect a large signup bonus in year one.

RapidRewards are a lower value currency. - Cancel or keep as you prefer.

Cards tend to be cost neutral. - Get companion pass for two years.

Arguably the best deal in family air travel.

United Airlines

Chase

- Club ($525)

- Quest ($250)

- Explorer ($95)

- Gateway ($0)

Strategy

- Collect a large signup bonus in year one.

- Product change to the free Gateway card.

Holding any United card gives you cheaper award prices.