How to Buy Stays

Introduction

In this game, we like to stay on points as much as possible, but there are situations where you may want or need to purchase a stay with actual money. Learning a few simple tricks can save you hundreds on every paid trip.

In one of my favorite paid stays of all time, I earned 83.3x points per dollar by stacking multiple promotions. A $250 three night stay in a nice beachfront Ramada earned enough points to cover $750 worth of lodging in Maui.

Easy Wins

These set and forget strategies can save as much as 45% on your hotel costs.

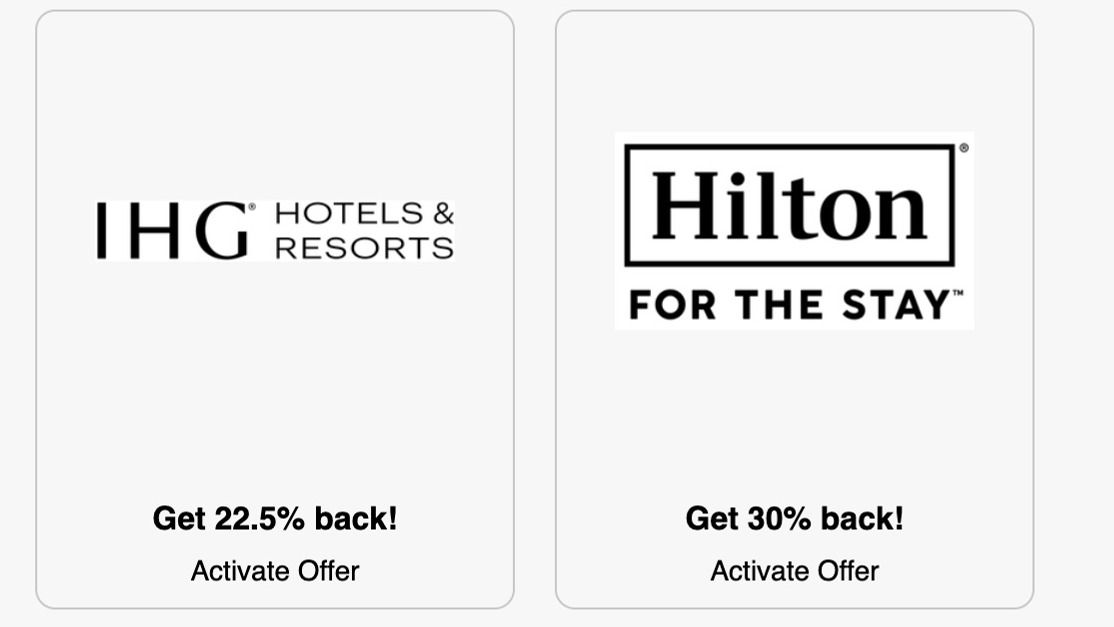

Use a Shopping Portal

Shopping portals can save you hundreds of dollars on hotel bookings or other purchases with about sixty seconds of effort. The two best are arguably Rakuten for reliability and Capital One Shopping for the best rates.

To use a shopping portal:

- Signup for the portal.

Capital One Shopping, Rakuten. - Optionally install their browser extension.

Required to get targeted offers. Great for set and forget. - Click on a link from the portal to the vendor

To Choice, Hilton, IHG, Marriott, etc. - Make your purchase on the vendor site as you normally would.

Within a few months of completing your stay:

- The vendor will pay the portal for the referral.

- The portal will pay you for the stay.

Hotels treat these bookings exactly the same as if you hadn’t clicked through a portal. This means that, unlike with bookings through third parties (Priceline, Travelocity, etc), your elite status will be honored, and you’ll earn hotel points in addition to your portal rewards. In some cases, you may be able to earn portal rewards for incidentals on award stays.

| Attribute | Capital One Shopping | Rakuten |

|---|---|---|

| Rewards | Redeem for gift cards. | Check or Amex Membership Rewards. |

| Time to Pay | Couple months after stay. | Couple weeks after stay. Quarterly. |

| Best Rates | 18-30% back, targeted. | 10-20x, several times per year. |

Caveat: Portals sometimes offering lower rewards for Hilton elite members, presumably because Hilton pays them less for those stays. Hilton is the only program that punishes elite members in this fashion.

Use High Earning Credit Cards

Paying with the right credit card can save you nearly 7% in the form of a points rebate. Imagine you have a Hyatt stay coming up and you have three cards to choose from. For the sake of simplicity, we’ll imagine we plan to transfer our Chase rewards to Hyatt which we’ll value at 1.8 cents per point.

| Card | Earn | Normalized Value |

|---|---|---|

| Amazon Prime | 1x Amazon | 1% |

| Sapphire Reserve | 3x Hyatt | 5.4% |

| World of Hyatt | 4x Hyatt | 7.2% |

You can get 7.2x the return using the hotel brand’s credit card over one that does not bonus travel spend. However, even if you don’t have every chain’s credit card, you can still get 5.4x the return using a good travel card.

Join the Loyalty Program and Get Status

For major hotel chains, if you don’t enter a loyalty number, you will likely end up paying a higher rate. Meanwhile, basic members often get a lower rate and earn 5-10% of their stay back in points. If you have status, that range can increase to 10-13% depending on the chain.

Earning by Tier

| Tier | Choice | Hilton | Hyatt | IHG | Marriott | Wyndham |

|---|---|---|---|---|---|---|

| 0 | 10x | 10x | 5x | 10x | 10x | 10x |

| 1 | *11x | *12x | *5.5x | 12x | 11x | 11x |

| 2 | *12.5x | *18x | 6x | *14x | *12.5x | *11.5x |

| 3 | 15x | *20x | 6.5x | *16x | *15x | *12x |

| 4+ | - | - | - | 20x | 17.5x | - |

* A credit card grants this status level.

Intermediate

This next set requires a little more effort, checking lots of different places for offers and then explicitly activating them.

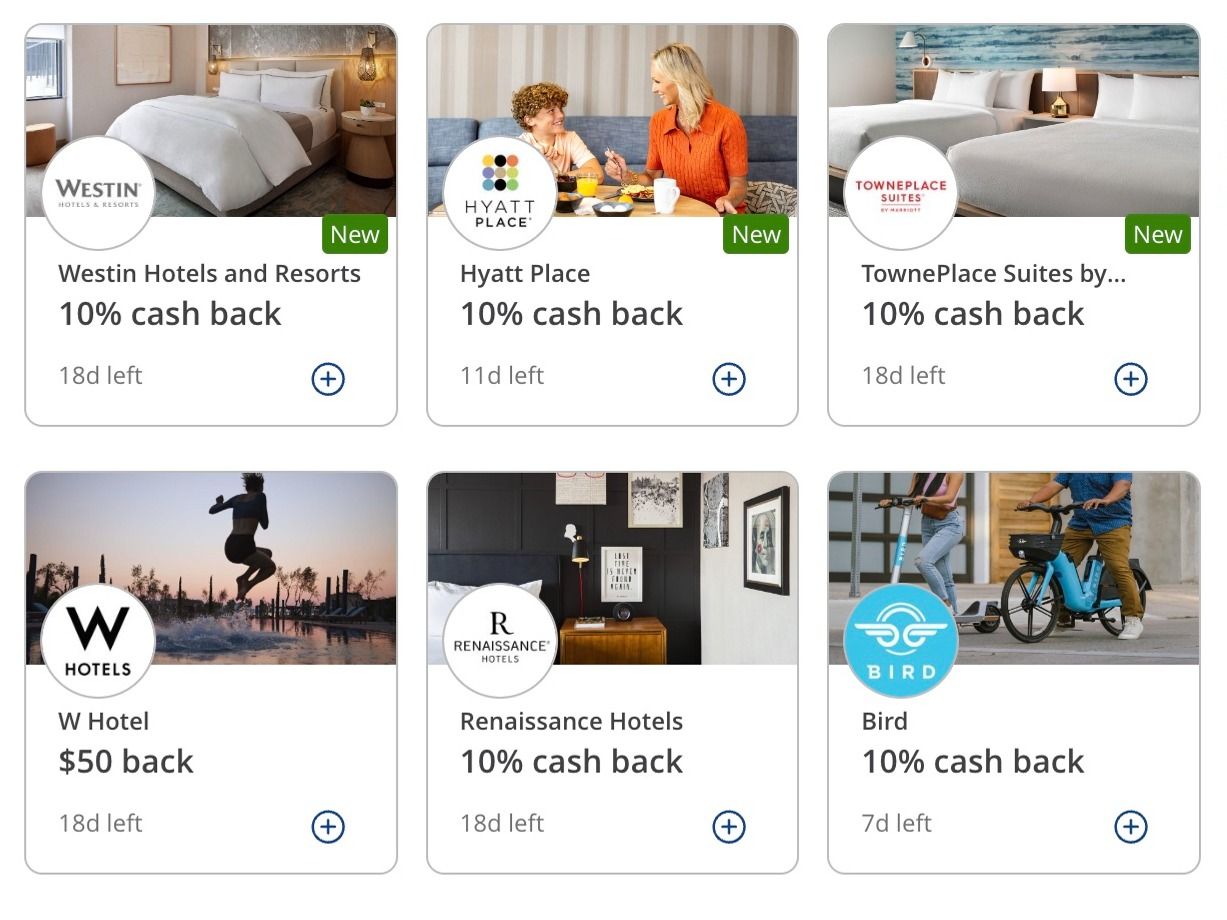

Card Linked Offers

Card issuers like Chase and Amex routinely offer large amounts of cashback for hotels on their non-hotel credit cards. So you might get a 10% back rebate on Hyatt from your Chase Sapphire card but not your Chase World of Hyatt card.

Chase hotel discounts tend to hover around 10% and may have maximum limits of $40-$100 back. You can usually add them to multiple cards.

Amex hotel discounts are larger but require additional spend, and you can only add them to one card. A typical example might be $150 off spend of $750 or more.

These offers come and go, but you can sometimes capture them by driving to your local hotel and buying a gift card. That said, hotel gift cards often come with some pain points.

Issuers aren’t the only places offering card linked offers.

- SimplyMiles for Mastercards.

- Visa Savings Edge for business Visas.

- Some shopping portals include them.

Hunting these down can be tedious, but they can be especially valuable, effectively increasing the value of your payment with other earning mechanisms. If you pay $500 and get $50 back from Chase a few days later, you will still earn credit card, hotel and shopping portal rewards on the full $500.

Hotel Promotions

Virtually every major hotel group is always running promotions, which often apply to both paid and award stays. Typically, they run for 2-3 months at a time, and registration is required.

Below are Hyatt’s promos over the past year.

- 2x points at Mr & Mrs Smith.

- 2x points on international stays.

- 1k points per night at Unbound.

- 3x points on Homes and Hideaways

- 2x points at Hyatt Place/House.

- 5k points every 3 nights in the Caribbean and Latin America.

- 1k bonus points and double elite nights in Florida.

- Double elite nights at Thompson and Dream.

- 20% off award redemptions for 90 days (targeted).

- 20% off paid stays in Asia Pacific.

- 3k points every 3 nights.

- 1k etihad miles per stay.

- 500 points/night at select properties.

Double points promos may be worth about 7.5% the cost of the hotel. Meanwhile, some of the fixed point awards like 3k per 3 nights can be highly advantageous if you find a cheap Hyatt. 3k points is worth at least $45 and there are some international Hyatts that price below $40. With some hotels, you may even be able to stack these promotions.

Buying Miles

Hotels sell points, and sometimes it is MUCH cheaper to buy points for an award stay than it is to pay a cash rate.

Why It’s Cheaper

You don’t pay most taxes.

- Hotel taxes can be especially high in tourist destinations or states without income tax.

- In some jurisdictions there will be a fixed nightly tax, but these are small and rare.

- Taxes can be 10-20% of your bill.

You often won’t pay destination fees.

- Destination fees are waived for Hilton, Hyatt and Wyndham.

- You still pay them at Choice, IHG and Marriott.

- This can be 10-50% the cost of some stays.

Arbitrage between cash and point rates.

- Hyatt and Wyndham award prices are fixed while cash rates vary.

- Hilton and Marriott sometimes have cheaper saver awards.

- Choice often charges the same award rate for suites as standard rooms.

4th/5th night free.

- IHG offers Premier cardholders the 4th night free on award stays.

- Hilton offers 5th night free to elite members.

- Marriott gives you the cheapest night of five for free.

- Make the 4th night that expensive saturday night stay to save 30%.

Some hotels offer perks only on award stays.

- Sometimes waived destination fees include food and beverage credits.

- Hyatt Globalists get free parking.

When to Buy Points and How Much

While you can find situations where it makes sense to buy any hotel currency, Choice, Hilton, IHG and Wyndham are known for having routine points sales.

Look for routine sales with these cents per point (cpp) rates.

- Choice @ 0.7cpp

- Hilton @ 0.5cpp

- IHG @ 0.5cpp

- Wyndham @ 0.9cpp

In late spring, the US Travel Association offers a week of Daily Getaway deals. The great ones can be amazing and sell out in seconds, but sometimes good deals last a few hours. This is a once per year event.

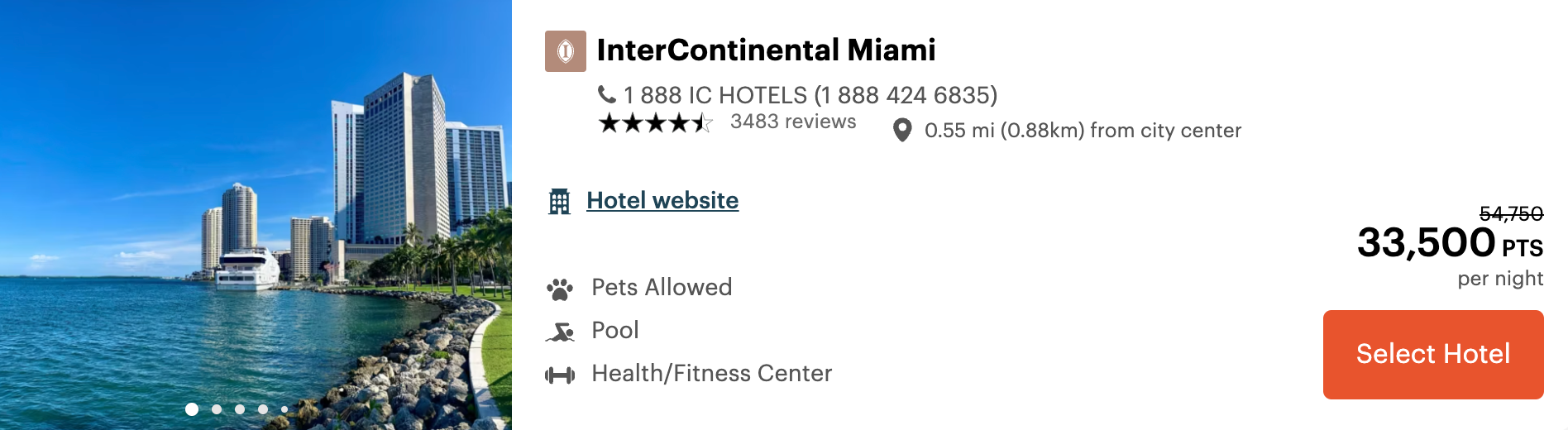

Real World Example

Let’s look at a real world example, using numbers from the IHG website. In this case, we’re trying to book four nights at the Miami InterContinental over Christmas.

- Using 4th night free saves 85k points.

- Buying points saves 50% on the cash price.

Show me detailed pricing

With a little effort, we can tease apart how much IHG charges for each night including the destination fee and taxes. For clarity, I’ve placed the points purchase price in parentheses based on IHG’s standard 0.5 cents per point sale.

| Item | Cash | Points |

|---|---|---|

| Tues. 12/24 | $227 | 35k ($175) |

| Wed. 12/25 | $246 | 41k ($205) |

| Thurs. 12/26 | $341 | 58k ($290) |

| Fri. 12/27 | $526 | |

| Room Subtotal | $1,340 | 134k ($670) |

| Destination Fee | $132 | $132 |

| Taxable Total | $1,472 | $132 |

| City Tax (6%) | $88 | $8 |

| State Tax (7%) | $103 | $9 |

| Cost of Points | $0 | $670 |

| Grand Total | $1,663 | $819 |

We are saving over 50% on the cash rate by:

- Buying points at 0.5cpp and redeeming at 0.65cpp against the nightly rate.

- Needing 85k fewer points due to 4th Night Free.

- Avoiding $175 in state and local taxes.

The math won’t always work out this well. Hilton tends to have less variation in their prices. On the dates you need, the free night could be the cheapest night, and you won’t always get a 0.65cpp base redemption.

I should also note that we haven’t factored in how many points you could be earning by paying cash, directly and indirectly.

Even so, we now have a tool to book many properties at a huge discount.

Buy Points with a Shopping Portal

While you won’t get 30% cashback, some shopping portals offer cash back on points purchases. For example, at the time of writing, Rakuten is offering the following discounts.

- 2% Choice

- 1.25% Hilton

- 1.25% Hyatt

- 1.25% Marriott